Explain the variances

- Financial Forecasting Overview

- Develop Salary Forecasts

- Develop

Non-Salary

Forecasts - Consolidate Forecasts

- Explain the variances

- 1 of 5

- 2 of 5

- 3 of 5

- 4 of 5

- 5 of 5

What are Forecast Variances?

Forecast variances are any differences between the total notional budget (approved budget and approved risk management items) and the total annual forecasted expenditures; i.e. surpluses or deficits of budget. As part of the periodical forecasting process, managers, working in conjunction with BMS/RMS or FMAS, are required to identify and explain these variances. This information will then serve to inform strategic decision making at the branch/region and departmental level.

Identifying and Explaining Forecast Variances

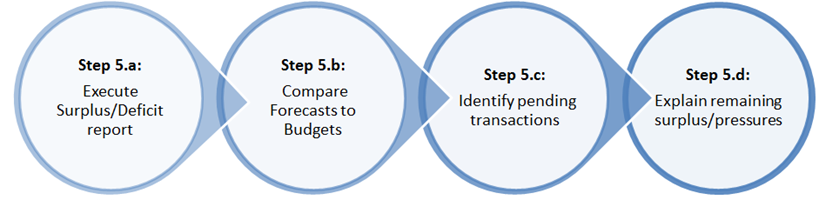

Long description

Step 5.a: Execute Surplus/Deficit report; Step 5.b: Compare Forecasts to Budgets; Step 5.C: Identify pending transactions; Step 5.d: Explain remaining surplus/pressures

An essential component of the forecasting process is the identification and explanation of forecast variances. These differences between approved funding and planned expenditures can stem from a number of different factors such as pending budget adjustments, a new project or increased workload, etc. This step of the forecasting process will require managers to:

Step 5.a: Execute the Surplus/Deficit Report

The Surplus/Deficit Report, accessible through the MSS folder of the myEMS (SAP) Portal, provides forecast information against notional budget (approved budget and approved risk management items), including commitments and actual expenditures.

For detailed information on how to access, execute and interpret the Surplus / Deficit Report, refer to the training documentation located in the Manager and Designate Reporting – Financial Management (FM) folder.

Step 5.b: Compare Forecasts to Notional Budgets by Commitment Item

The notional budget is made up of the approved budget and approved risk management which corresponds to additional anticipated funding with a known source of funds, that has been approved for planning purposes but that has not yet been allocated. Using the Surplus/Deficit Report, managers must compare total annual forecasted salary and non-salary expenditures with the Notional Budget. Any discrepancies between the forecasts and the available budget should be identified and, subsequently explained.

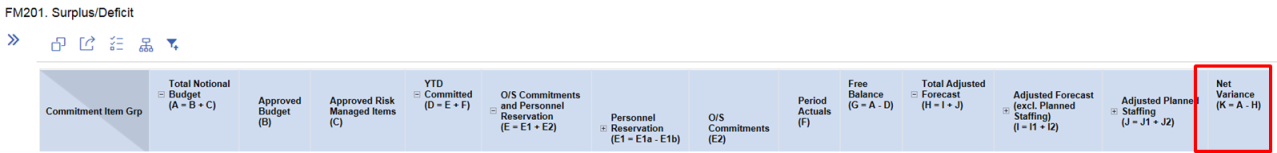

Long description

FM201 Surplus/Deficit column headings: Commitment Item Grp, Total National Budjet (A=B+C), Approved Budjet (B), Appropved Risk Management Items (C), O/S Commitments and Personnel Reservation (E=E1+E2), Personnel Reservation (E1=E1a-E1b), O/S Commitments (E2), Period Actuals (F), Free Balance (G=A-D), Total Adjusted Forecast (H=I+J), Adjusted Forcast (excl. Planned Staffing)(I=I1+I2), Adjusted Planned Staffing (J=J1+J2), (Highlighted with red border) Net Variance (K=A-H)

Step 5.c: Identify Pending Transactions

Since the budget information used in the forecasting exercise is fixed as of the last day of the fiscal period directly proceeding the forecast period (e.g. period 2 budgets used to develop period 3 forecasts) it is possible that some of the forecasting variances are the result of transactions that have yet to be processed in myEMS (SAP). It is important to identify these pending transactions since these types of surpluses or deficits shouldn’t impact strategic decision making for the branch/region or the department.

Common pending transactions include:

- Internal budget transfers between funds centers that could serve to cover an identified funding shortfall or use up lapsed funds;

- Operating Budget Adjustments (OBA) to convert non-salary budget to salary budget, or vice-versa.

- Pending allocations of known and secure funding, such as additional budgets linked to a newly approved Treasury Board Submission.

Step 5.d: Explain Any Remaining Surpluses and Pressures

Once the pending transactions identified in the proceeding step have been removed from the total identified forecasting variances, managers are responsible for explaining any outstanding differences between budgets and forecasts.

- For surpluses, managers will need to indicate whether the funds are available to be repatriated and reallocated elsewhere in the branch/region/ department.

-

For pressures, managers are required to provide an explanation that:

- Identifies what activities are causing the funding shortfall; e.g. a specific project;

- Explains whether the situation is linked to an ongoing function such as existing indeterminate staff or an emerging situation such as unexpected increase in workload;

- Outlines why there is insufficient budget to cover the planned expenditures;

- Explains the consequences of not receiving the requested additional funding; and

- Provides an exit strategy in the event that the requested funding is not allocated.

With regards to identified pressures, it is important to note that the risk management is not permitted without approval from the Portfolio Management Board (PMB). As such, managers should not spend on any pressures identified in their forecast until they have received official approval to do so.

Managers must provide their explanation of forecast variances to the BMS/RMS or FMAS, depending on the organizational structure of the branch or region, so that they can be reviewed as part of the results consolidation and integrated in the overall branch/region forecast analysis.

For Assistance

- If you are experiencing technical issues with any of the myEMS (SAP) tools, Report an incident

- If you have questions relating to the forecasting process, contact your BMS/RMS or FMAS, depending on the organizational structure of your branch or regions.