Travel Guide for Non-Public Servants (NPS)

This guideline is intended to assist travel arrangers and managers through the process of submitting paper travel claims for Non-Public Servants (NPS) traveling on government business.

Travel is managed with prudence and probity, in a manner that maximizes effectiveness in meeting organizational mandates, minimizes costs and demonstrates value for money. The number of travelers should be limited to the minimum necessary and the most economical means should be selected given the nature of the trip. All travel must be pre-approved.

The National Joint Council Travel Directive applies to all persons traveling on government business as well as the Special Travel Authorities (7. Persons on contract). In addition, please consult the Cyclical Review – Highlights of Changes – Travel Directive – July 1, 2017. The Departmental Procedures related to Travel, Hospitality, Conference and Event Expenditures (THCEE) may also be consulted if the travel is related to an organized event.

All paper travel claims for NPS are submitted through the iService Gateway for Travel Support. Please indicate the traveler’s province in the request and submit one travel claim per request/ticket. The following supporting documentation must be attached to the ticket:

1. Travel Authorization (FIN5030) OR Travel, Hospitality, Conference and Event Expenditure (THCEE) Form

***Please note that the FIN5030 represents the formal contract between ESDC and the NPS regarding the authorized spending limits***

Travel Authorization (FIN5030)

Travel Authorization (FIN5030)

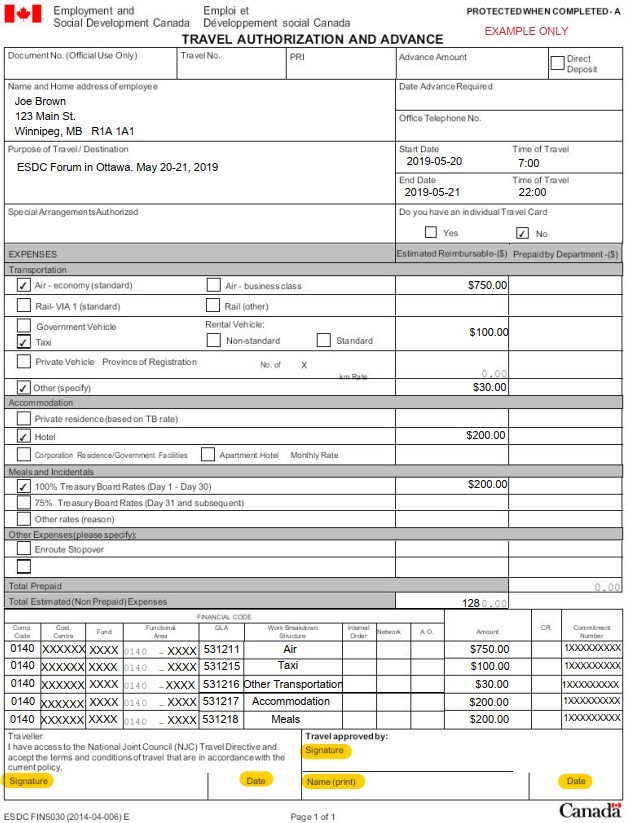

Travel Authorization (FIN5030):

- Form must be completed in its entirety (i.e.) name and address of traveler, purpose of travel, start and end dates of trip, financial coding, and estimated amounts.

- Signed by a current delegated Section 32 manager for the cost centre specified on the form (print name of signee & date of signature).

- Example: see Appendix A.

THCEE form

THCEE form

- When the FIN5030 is not available, THCEE form/Travel plan will be accepted only if all the information typically provided on the FIN5030 is included on the THCEE form/Travel plan.

- NPS names are required. If not listed on the THCEE/travel plan, provide the invitation or participants list.

- Always provide readable copies.

- For information, please see: Departmental Procedures related to THCEE.

2. Travel Expense Claim (FIN5031)

Travel Expense Claim (FIN5031)

Travel Expense Claim (FIN5031)

Travel Expense Claim (FIN5031)

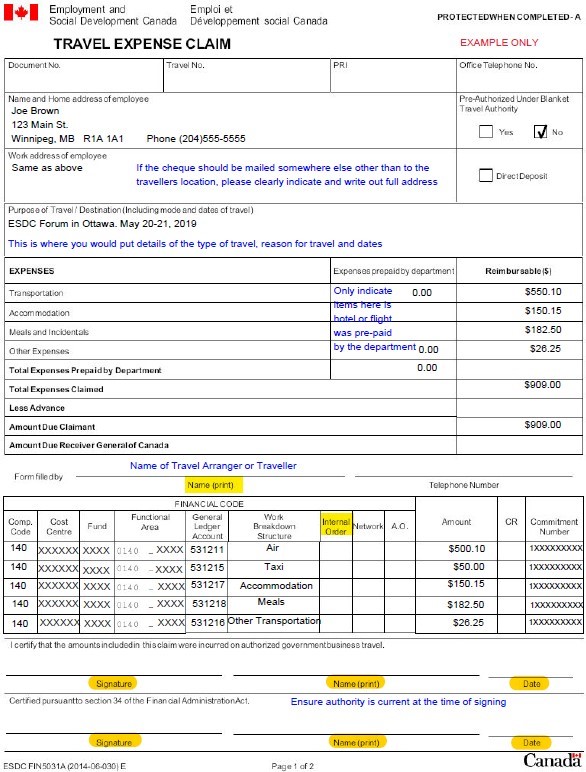

- Form must be completed in its entirety (i.e.) name and complete address of traveler, purpose of travel, start and end dates of trip, financial coding, commitment number, internal order number (if applicable), and amounts.

- It is important to ensure that the funds commitment is set up properly with the correct financial coding and a sufficient amount of funds to cover all travel expenses.

- Form must be signed by a current delegated Section 34 manager for the cost centre specified on the form (print name of signee & date of signature).

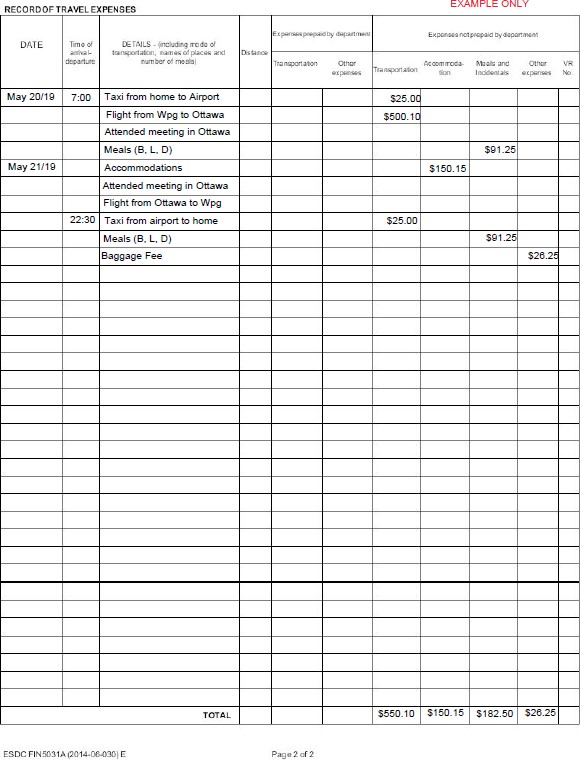

- Record of Travel Expenses sheet (page 2 of FIN5031) must be filled out in detail (date, time, details, amounts and kilometer distances, if applicable).

- Example: see Appendix B.

3. Receipts

All receipts and supporting documentation relevant to the travel claim must be attached to the ticket.

Prepaid Expenses

Prepaid Expenses

- Prepaid Airfare/Train - the Travel Authorization Number (TAN) is required for prepaid airfare or train expenses in order to book with the governmental travel agency (HRG). Requests for a TAN can be submitted through the Gateway for Travel Support. A signed copy of the FIN5030 or the THCEE form with the traveler’s name and the commitment number must be attached to the request. Once the TAN is assigned, the travel arranger can make reservations online or by calling HRG (1-866-857-3578) using the off-line TAN that was provided.

- Prepaid Hotel - in occasional circumstances (i.e. no personal credit card available, Homelessness Program), hotel accommodations can be prepaid using a Departmental Travel Expense Card (DTEC). Please contact the DTEC cardholder in your branch or region for more information.

Reimbursable Expenses

Reimbursable Expenses

- Accommodation - The Government of Canada Accommodation and Car Rental Directory shall serve as a guide for the cost, location and selection of accommodation. Unlisted hotels may be used if justified by cost savings. As a guide to determine reasonable accommodation costs, the Canadian City Rate Limits have been established. A traveler who chooses to stay in private non- commercial accommodation will be reimbursed the rate specified as per Appendix C of the Travel Directive.

- Meals - a traveler shall be paid the applicable meal allowance for each breakfast, lunch and dinner while on travel status in accordance with the rates specified in Appendix C of the Travel Directive. A meal allowance shall not be paid to a traveler with respect to a meal that is provided (i.e. included with hotel, airfare/train or hospitality provided at an event).

- Personal Vehicle - travelers authorized to use their personal vehicle will be reimbursed mileage in accordance with the rates specified in Appendix B of the Travel Directive, and the rates vary by province.

- Taxi - taxis, shuttles and local transportation services are alternatives for short local trips. Actual expenses, including gratuities, shall be reimbursed. Receipts are only required for expenses in excess of $12.

- Incidentals - the incidental expense allowance is NOT applicable to NPS.

Important Information

Important Information

- Booking Air Travel - the standard for air travel is economy class. The lowest available fares appropriate to particular itineraries shall be sought and bookings be made as far advance as possible.

- Business Class Air Travel - business class air travel is not permitted for NPS travelers. Requests for an exception must be submitted to the Deputy Minister or Minister for approval on a case- by-case basis and supported by a full rationale. Upgrades to business or first class may be personally paid by the contractor or private sector company, where this is company policy.

- Commitment Number - each form must have the commitment number indicated. Please contact your FM advisor to open a travel funds commitment with the estimated costs to be used in the expense claim. It is important to ensure that the funds commitment is set up properly with the correct financial coding and a sufficient amount of funds to cover all travel expenses.

- General Ledger Accounts (GL)- are specific to the category of travel and travel expense for NPS. Use the appropriate GL for each travel expense in the financial coding area on the FIN5030 and FIN5031.

- Prepaid Expenses - all prepaid expenses must be indicated on the FIN5030 and FIN5031 forms under the right column (Expenses prepaid by department). The TAN must also be indicated and the HRG invoices attached.

- Meals - it is important to clearly identify the type of meal allowance claimed and/or which type of meal was provided (i.e. breakfast, lunch, or dinner) on the Record of Travel Expenses sheet (page 2 of FIN5031 form).

For additional information on travel, please visit the National Joint Council Travel Directive and the iService Travel Road Map. For further assistance, please call the Travel Helpline 1-855-684-7827 option 1.

Appendix A: Example of Travel Authorization (FIN 5030)

Travel Authorization (FIN 5030)

Appendix B: Example of Travel Expense Claim (FIN 5031)

Travel Expense Claim (FIN 5031)

Appendix B continued: