How to Enter HRG/ GBT Prepaid Airfare and Train Expenses in your Travel Expense Claim

For every Travel Authorization Number (TAN) that is issued, a corresponding travel expense claim needs to be created in myEMS.

- If a TAN was issued through a travel request, the TAN should pre-populate in the corresponding travel expense claim.

- If an emergency offline TAN was issued, please enter it in the “Offline TAN” field.

- If there were any issues with the TAN, or if a modification was made to the TAN reservation, please input this information in the “Comments” field of the travel expense claim.

- If the trip was cancelled and the TAN was not used, a travel expense claim is still required, advising of such.

HRG/ GBT Receipts:

An entry must be created for each invoice received from HRG/ GBT in the “Enter Receipt” section of your travel expense claim.

- If a trip was cancelled, the trip may qualify for a credit that can be applied against future travel. As HRG/ GBT will still issue a receipt for a cancelled trip, a travel expense claim is still required in order to enter the applicable airfare and/or train fare.

- If a TAN was issued, but no reservation was made with HRG/ GBT, please enter “$0.00” in the expense type “HRG/ GBT service fee”.

- If a hotel was booked through HRG/ GBT, a service fee will be charged.

Please refer to the HRG/ GBT Itinerary Receipt and Invoice in order to enter the correct amounts in your travel expense claim. The traveller should have received a copy via email; a copy may also be obtained from the HRG/ GBT website by following this procedure.

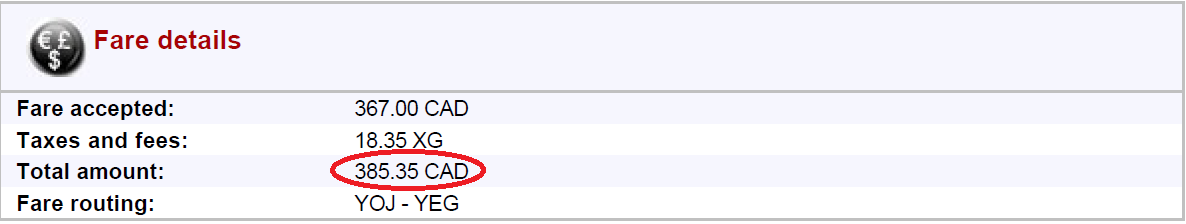

- Airface/Train paid by ESDC:

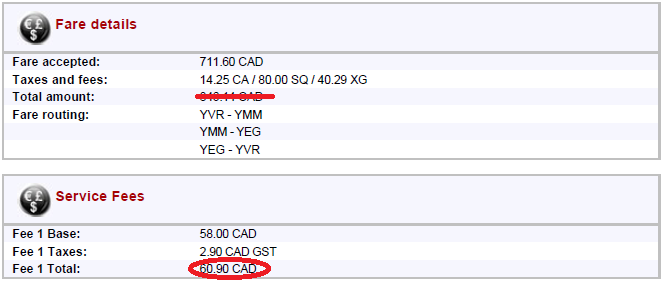

- Enter the total amount (including taxes) from the Fare details section.

- Jurisdiction code: use the tax jurisdiction code for the province where first flight on the invoice originated.

- Example 1: If your flight was a return flight from Ottawa to Vancouver, then both the jurisdiction code for the flight and HRG/ GBT service fee should be CAON for Ontario.

- Example 2: If your first flight was from Ottawa to Vancouver with Air Canada, and then the return flight was from Vancouver to Ottawa with WestJet, then the first flight (and its service fee) should be the Ontario jurisdiction code of CAON then the second flight (with its service fee) should be the British Columbia jurisdiction code of CABC.

- Exception: For an international flight, since there will be no tax on the invoice for the flight, the jurisdiction code to use is CAZZ and the tax jurisdiction for the service fee should be the province of departure.

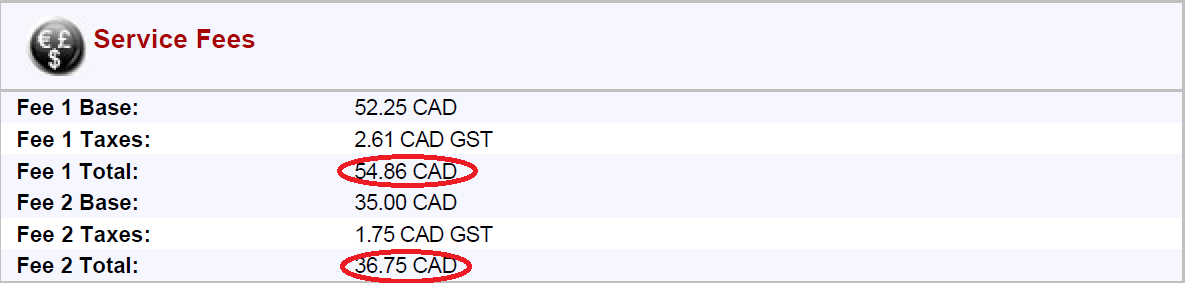

- HRG/ GBT Services Fees:

- Enter the Fee 1 Total and Fee 2 Total (if applicable) from the Service Fees section.

- Jurisdiction code: use the tax jurisdiction code for the province where first flight on the invoice originated.

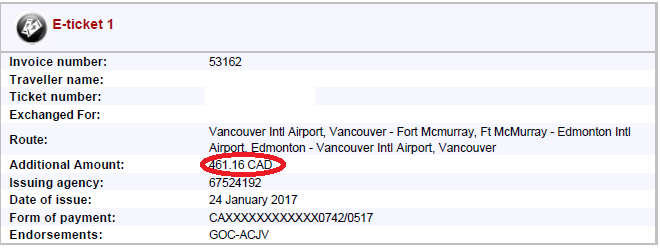

- Changes to an existing reservation:

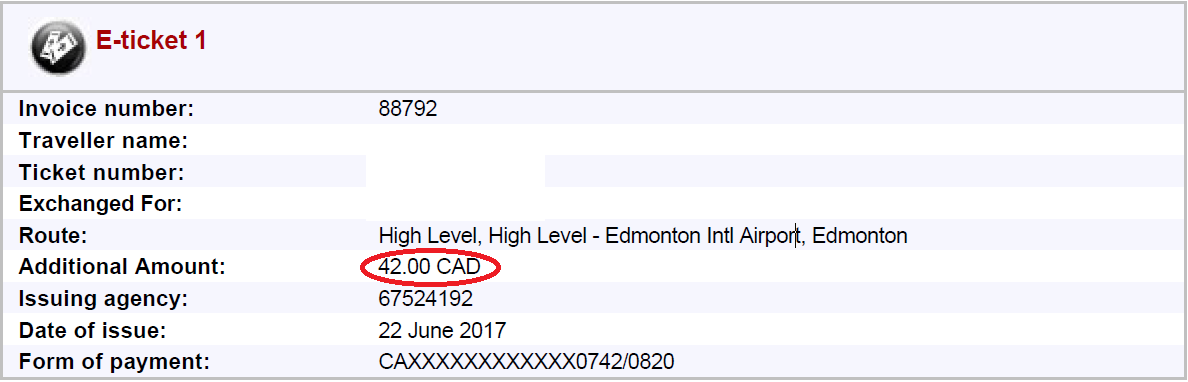

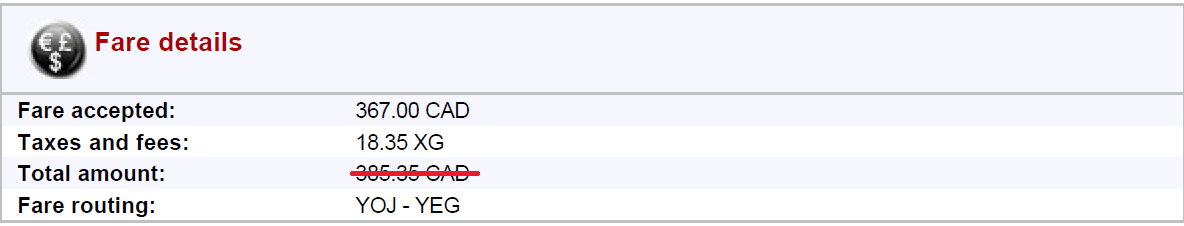

- When changes are made to an existing reservation, make sure to look on the HRG/ GBT website in order to have all the itinerary receipts and invoices for the trip. After entering the amount(s) and service fee(s) from the first invoice, enter the Additional Amount in the E-ticket section as well as the HRG/ GBT service fees found on the second invoice. Do not re-enter the total amount in the Fare details section as this amount should already be entered from the first invoice.

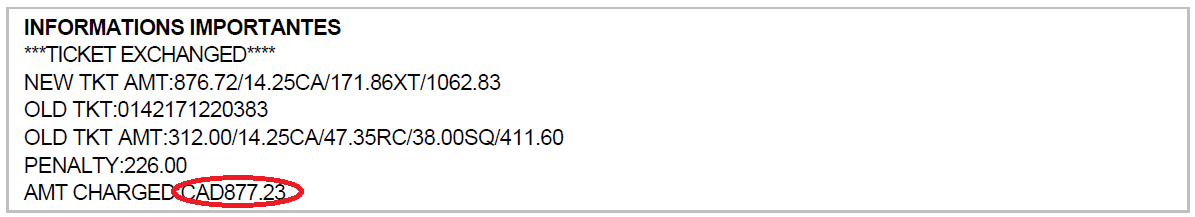

- Notice when a ticket is exchanged:

- When a ticket is exchanged, the following notice is displayed near the beginning of the Itinerary/Invoice in the Important Information section:

- Enter the Amt Charged as the airfare in the Travel Expense Claim:

- When a ticket is exchanged, do not enter the amount under fare details, only enter the amount charged in the “Important information” section.

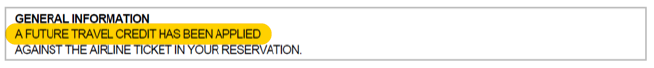

- Notice when a credit is applied:

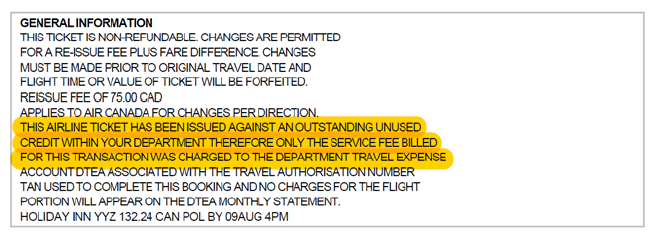

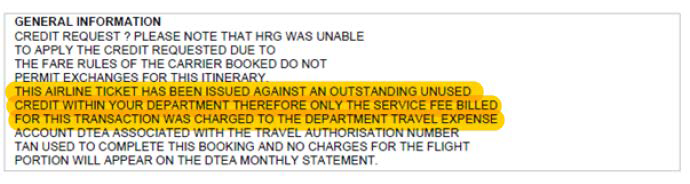

- When a credit is applied to a reservation, whether an Individual or Departmental credit, either of the following notices is displayed on the Itinerary/Invoice in the General Information Remarks section:

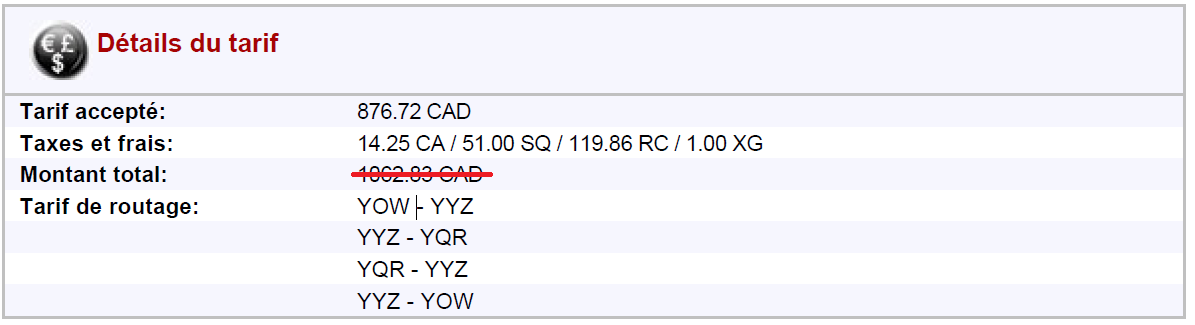

- 5.1 If the credit is lower than the total amount for the airfare/train, the comment below will be displayed. In this case, the amount to enter in the travel expense claim will be displayed under the “E-ticket” section and not the amount in fare details.

- 5.2 When a credit is applied for the full amount of the airfare/train, the comment below (or a similar one) will be displayed. Do not enter the amount for the airfare/train in the Travel Expense Claim. However, the HRG/ GBT service fees will still need to be entered in the Travel Expense Claim.

- 5.3 This is another example of a credit that was applied for the full amount. The first part of this comment is stating that a personal credit has not been applied, but a departmental credit was applied instead. In this case, only the service fee should be entered in the travel expense claim.

- If you need assistance with the prepaid amounts when creating your expense report, please call the Travel Unit helpline. If you do not agree with the prepaid charges or if you cannot find your invoices online, please contact HRG/ GBT directly.

Travel Unit Helpline (ESDC): 1-855-684-7827 option 1

HRG/ GBT: 1-866-857-3578

How to Retrieve a Copy of the HRG/ GBT Itinerary Receipt and Invoice

Generally, when the traveller or travel arranger books prepaid airfare or train, the traveller will receive an electronic copy of the “Itinerary and Invoice” from the following GD box: donotreply@HRGworldwide.com.

There is a PDF attached to this email.

This is the invoice that should be attached to the Travel Expense Claim in myEMS as this is the only place where the HRG/ GBT service fee will be displayed.

If the traveller or travel arranger does not receive the invoice, or if some modifications were made after the initial booking, there might be another invoice on the HRG/ GBT website.

Here is the procedure to retrieve the invoice from the HRG website:

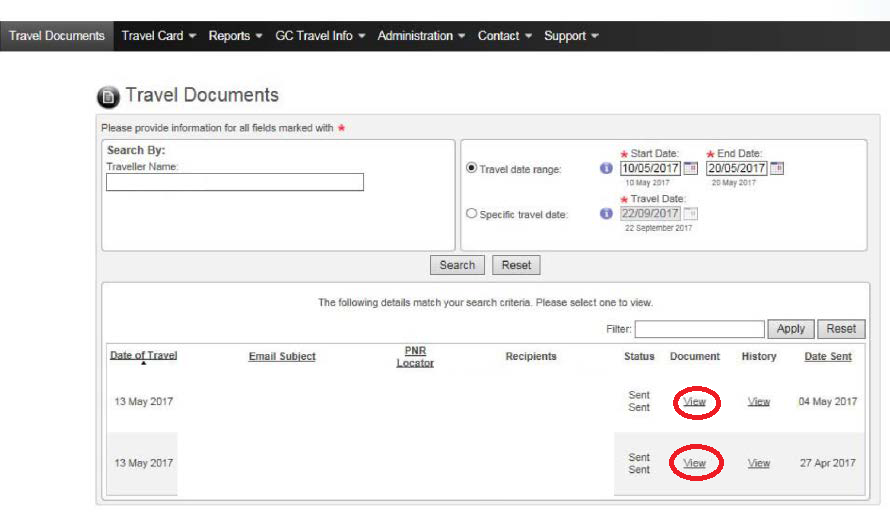

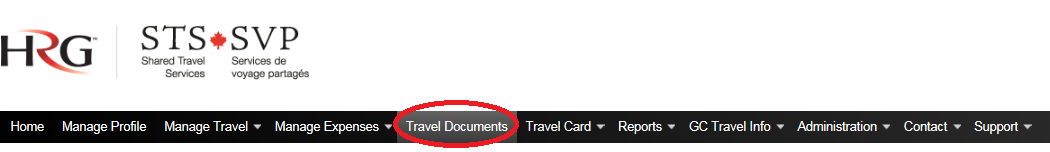

- Click on “Travel Documents”.

- If it’s for another traveller, enter their name in the field “Traveller Name”.

- Search for the invoice using “Travel Date Range” or “Specific Travel Date”. It is recommended to search using “Travel Date Range”; enter a few days before departure date and a few days after the return date to get the best results.

- In the example below, the name and information of the traveller have been deleted but it can be seen that two invoices were issued for this travel. Print a copy or send it via email by clicking on “View” under the “Document” column.