Departmental Claims and Ex Gratia Payments Policy

For questions or comments, please contact us :

NC-CFOB-Financial_Policy_Questions_Politique_Financière-GD

Last revision: June 2011

This document last modified: January 2013

Please Note: This policy/document is currently under review and is being updated to reflect new procedures and terminology associated with the implementation of myEMS (SAP)

Table of Contents

- Policy Objective

- Policy Statement

- Application

- Policy Requirements

4.1 General

4.2 Exclusions

4.3 Claims

4.4 Investigation and Assessment

4.5 Legal Requirements

4.6 Claim Resolution

4.7 Liability Payments

4.8 Ex Gratia Payments

4.9 Release - Roles and Responsibilities

5.1 Chief Financial Officer

5.2 Departmental Managers

5.3 Chief Security Officer - Delegations of Authority

- Monitoring

7.1 Duty to Accommodate

7.2 Monitoring and Reporting Requirements - Definitions

- References

9.1 Relevant Acts

9.2 Treasury Board Policies, Directives and Guidelines

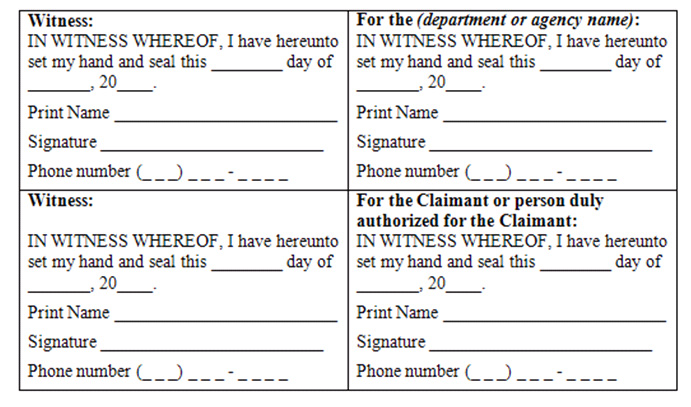

9.3 Other - Appendix A1 – Diagramme des responsabilités du gestionnaire

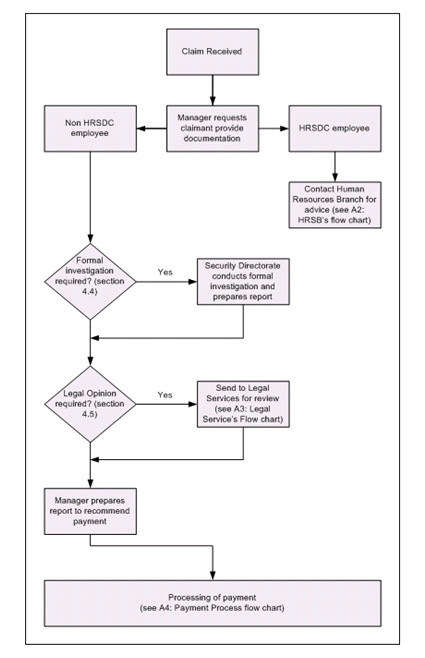

- Appendix A2 – Human Resources Services Branch Responsibilities Flow Chart

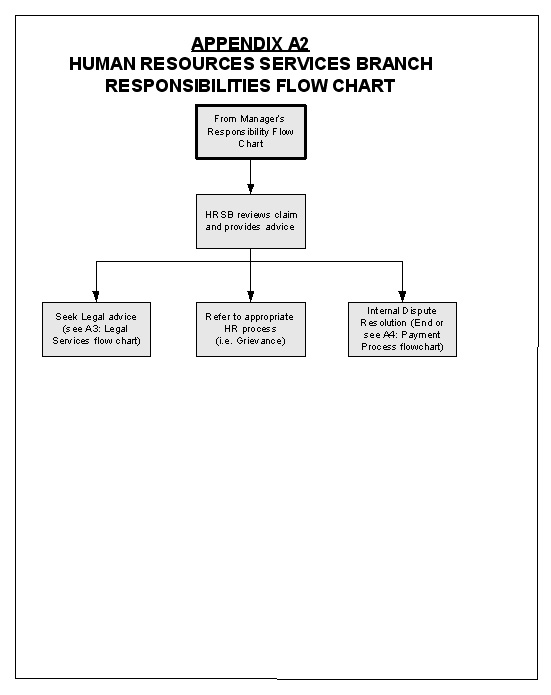

- Appendix A3 – Legal Services Responsibilities Flow Chart

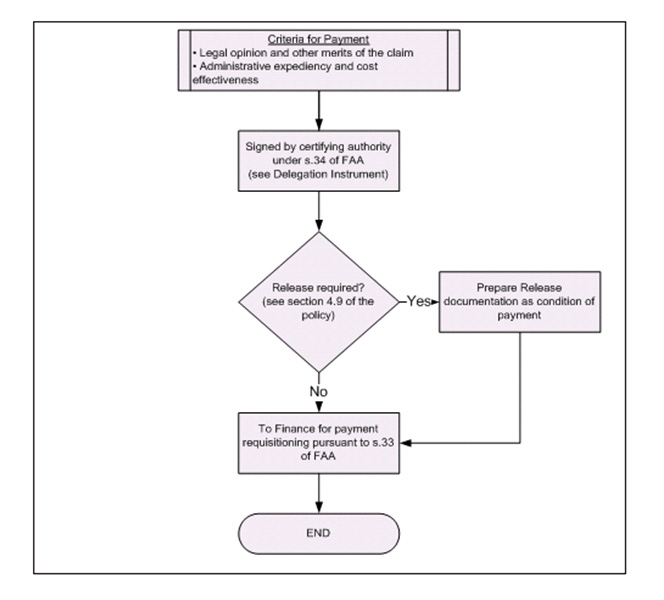

- Appendix A4 – Payment Process Flow Chart

- Appendix B – Guidelines

- Appendix C – Frequently Asked Questions

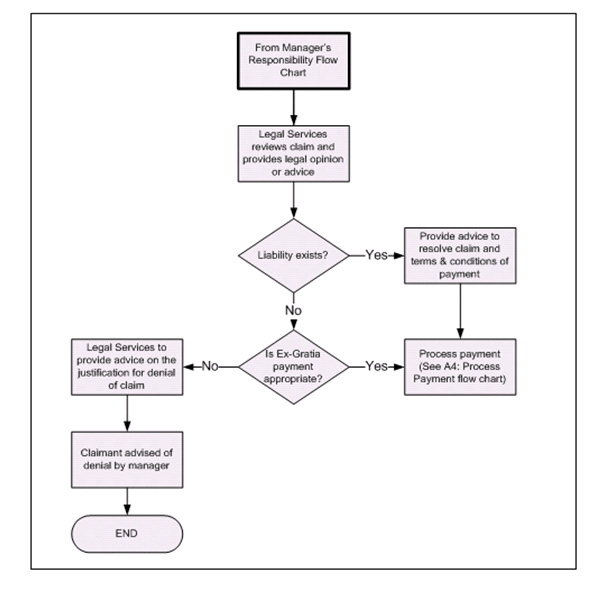

- Appendix D – Statement of Release (example)

Context

The purpose of this policy is to ensure the efficient and effective resolution of claims by and against Her Majesty in Right of Canada (the Crown) arising from government operations. Claims by or against the Crown may arise even when parties involved in the conduct of government business have been acting in good faith.

This policy supports the objectives of the Treasury Board Policy on Internal Control with respect to the prudent stewardship of public funds, the safeguarding of public assets, and the effective, efficient and economical use of public resources.

The policy outlines the roles and responsibilities of the department’s Chief Financial Officer, its managers (including those with delegated authorities to make payments), and the Chief Security Officer in processing claims and ex-gratia payments.

Claims may include requests for compensation to cover losses, expenditures or damages sustained by the Crown or a claimant, including requests or suggestions that the Crown make an ex gratia payment.

When the requirements of this policy are met, the Deputy Minister has the authority to:

- Accept amounts in settlement of claims by the Crown;

- Recover from servants any amounts servants owe to the Crown;

- Pay amounts in settlement of claims against the Crown; and

- Make ex gratia payments.

The spending and certification authorities of this policy may be exercised by an official designated by the Deputy Minister except that only the Deputy Minister may approve ex gratia payments exceeding $2,000. Note that the Treasury Board Policy on Legal Assistance and Indemnification applies when making decisions whether to approve requests for legal assistance and indemnification related to Crown servants subject to legal claims and actions.

1. Policy Objective

To ensure adequate and timely settlement and payment of claims by or against the Crown and against its servants, and timely and accurate processing of ex gratia payments.

2. Policy Statement

This policy applies to ex gratia payments. It should apply only when there is no statutory, regulatory or policy vehicle to make the payment.

It does not apply to claims between departments. Such claims are dealt with on the basis of mutual forbearance.

It does not apply to claims between the department and Crown corporations. Such claims are resolved by negotiated settlement or, when negotiations fail, are referred to the Deputy Attorney General of Canada.

3. Application

This policy will apply to Human Resources and Skills Development Canada (hereinafter referred to as HRSDC, the “Department” or “Departmental”).

4. Policy Requirements

4.1 General

4.1.1

It is the department’s policy that the settlement of claims by and against Her Majesty in Right of Canada (the Crown) is carried out efficiently, effectively and legally.

4.1.2

This policy supports and is to be read in conjunction with the following:

- Treasury Board Directive on Claims and Ex Gratia Payments;

- Treasury Board Guideline on Claims and Ex Gratia Payments;

- Treasury Board Policy on Internal Control; and

- Treasury Board Policy on Legal Assistance and Indemnification.

4.1.3

This policy applies to the Crown, as represented by the Minister, and every individual appointed or employed as a servant, any minister, agent and former servant, and the estate of a deceased servant.

4.2 Exclusions

4.2.1

This policy does not apply to any person engaged under a contract for services.

4.2.2

This policy does not normally apply to claims resulting from bidding or contract performance disputes.

4.2.3

This policy does not apply to claims that are covered by other authorities, governing instruments, or policies.

4.2.4

Intradepartmental and interdepartmental disputes must be resolved without claims for damages.

4.3 Claims

4.3.1

Claims are defined as request(s) for compensation to cover losses, expenditures, or damages sustained by the Crown or a claimant, including requests or suggestions that the Crown make an ex gratia payment. They can be settled in or out of court, and can be broadly divided into two categories:

- Claims in tort, which are those in which there is no form of contractual agreement between the Crown and claimant(s); and

- Claims in contract, which should be dealt with according to the terms of the contract, the Treasury Board Contracting Policy and the applicable law.

4.3.2

A claim against the Crown is a request for compensation that is settled in or out of court for monetary compensation to, or indemnity for, the loss, detriment, or injury of the claimant.

4.3.3

Where a claim is made against the Crown, the claimant must be asked to provide the following information:

- A detailed statement of the facts upon which the claim is based;

- A detailed statement of the calculation of the claim; and

- Copies of relevant documents substantiating any disbursements.

4.3.4

A claim by the Crown is a request for compensation that is settled in or out of court but for which the Crown may be entitled to monetary compensation for, or indemnity for, loss, detriment, or injury.

4.3.5

Any money collected for claims by the Crown should be deposited to the credit of the Receiver General and not be credited back to an appropriation.

4.3.6

Where a claim is made against a servant of the Crown, the Treasury Board Policy on Legal Assistance and Indemnification must first be referred to. Servants may be indemnified by the Crown and protected from certain financial costs arising from the performance of their duties.

4.3.7

Where a servant of the Crown is not indemnified, if the Crown intends to recover money owing from the servant through the retention of any money that may be due or payable, then the servant must be duly notified of the proposed retention and the right to make representation and the servant’s representation must be considered prior to making a final decision.

4.3.8

Claims between the department and Crown corporations should be resolved through negotiated settlement whenever possible.

4.4 Investigation and Assessment

4.4.1

The purpose of the investigation and assessment of the incident, which must be carried out in a timely fashion, is to:

- Establish the cause of the incident;

- Assess the extent and value of damages and potential legal liability;

- Establish supporting documentation for the payment; and

- Prevent recurrence.

4.4.2

The scope and details of the investigation and assessment activities will depend on the complexities of the incident and should be comparable to the amounts involved.

4.4.3

Statements should be objective and limited to the relevant facts as necessary such as:

- A description of the incident (e.g. what happened, who was involved, which official language was used);

- Statements from persons involved, as well as any witnesses;

- Statements of the scope of the duties of any servants of the Crown involved, as well as the nature of, and reasons for, their involvement, including whether they were travelling or were at their normal place of work;

- Information related to the use of any Crown property and the authority for such use;

- Estimates and explanations for damages;

- Sketches and photographs, or descriptions such as geographic location, climatic conditions, and time of day;

- Details of any expert advice such as from the Royal Canadian Mounted Police, the Department of Justice, private sector claims adjustment services or collection agencies;

- Any relevant statutes or other forms of compensation; and

- Summaries of relevant procedures in place to manage the risk of such incidents, mitigate further or future risk, and any corrective action taken.

4.5 Legal Requirements

4.5.1

A legal opinion should address:

- The liability, if any, of the Crown; and

- What steps, if any, should be taken to resolve the claim, taking into account relevant cost-effectiveness and the terms and conditions on which it would be advisable to resolve the claim.

4.5.2

All claims involving legal proceedings must be referred to Legal Services, Department of Justice, except where otherwise prescribed by the Treasury Board policy.

4.5.3

A legal opinion must be obtained before undertaking to pay in excess of $25,000 to resolve a claim against the Crown.

4.5.4

A legal opinion must be sought regarding claims by the Crown where substantial sums (greater than $1,000) are at stake or if there is uncertainty as to the relevant facts or applicable legal principles.

4.5.5

A legal opinion may be obtained in any other case.

4.5.6

Refer to Appendix A3 for a flow chart outlining Legal Services responsibilities.

4.6 Claim Resolution

4.6.1

Settlement is the process whereby an agreement is reached through negotiation between the parties to resolve a claim.

4.6.2

A claim may also be resolved and costs may be awarded by a judgment, i.e. a decision rendered by the courts.

4.7 Liability Payments

4.7.1

In assessing whether to make a liability payment in settlement of a claim, other factors that should be considered include:

- The legal and other merits of the claim;

- Administrative expediency; and

- The overall cost-effectiveness in resolving claims.

4.8 Ex Gratia Payments

4.8.1

In exceptional circumstances, the ex gratia payment is a vehicle that may be used to provide “a benevolent payment in the public interest for loss or expenditure incurred for which there is no legal liability on the part of the Crown.”

4.8.2

Before undertaking to make an ex gratia payment, all other reasonable means of compensation or legal authorities must be considered, such as:

- Statutory or regulatory schemes;

- Relevant programs;

- Central agency and departmental policies;

- Contract or agreement provisions;

- Commercial insurance;

- Grants or contributions; or

- Possibility of recovery from third parties.

4.8.3

Ex gratia payments should not be made to fill perceived gaps or to compensate for the apparent limitations of any act, order, regulation, policy, agreement or other governing instruments.

4.9 Release

4.9.1

A release, by definition, relinquishes the claimant of any further rights, claims, or demands growing out of the incident.

4.9.2

For claims against the Crown, a statement of release (normally prepared by Legal Services) shall be obtained (refer to Appendix D for example) in consideration of resolving a claim.

4.9.3

The Deputy Minister may sign a release as a condition of payment being made to resolve a claim by the Crown.

4.9.4

A statement of release is not normally required for an ex gratia payment.

5. Roles and Responsibilities

5.1 Chief Financial Officer

The Chief Financial Officer is responsible for:

5.1.1

Ensuring that management practices and controls expedite settlement and payment of claims, including ex gratia payments, and clearly indicate the following:

- The roles and responsibilities of the financial management personnel for the processing of claims, including ex gratia payments;

- That claims by or against the Crown that are covered by other authorities, governing instruments or policies are to be processed pursuant to those other authorities;

- The process for reporting incidents that could result in a claim by or against the Crown arising from government operations;

- The process for obtaining a legal opinion or advice from Legal Services on the claims, including ex gratia payments, by or against the Crown;

- The process for conducting investigations in consultation with the Chief Security Officer;

- The spending authorities delegated under this policy;

- The certification authorities delegated under section 34 of the Financial Administration Act with respect to payments to claimants; and

- That all payments of claims against the Crown, ex gratia payments and court awards are reported in the Public Accounts in the fiscal year that payment is made (Receiver General Manual, Chapter 15, “Public Accounts Instructions“).

5.2 Departmental Managers

5.2.1

Departmental managers responsible for Claims against the Crown and ex gratia payments are responsible for the following:

- Requesting that the claimant provide facts upon which his or her claim is based, showing how it is calculated and original copies of documents confirming all disbursements;

- Referring claims to Legal Services:

- When the claim involves legal proceedings;

- To obtain a legal opinion when considering payment of an amount greater than $25,000 to resolve a claim; or

- When the payment is ex gratia.

- Conducting, with the assistance of the Chief Security Officer as required, an investigation of reported incidents for claims of servant’s effects that are damaged, lost, stolen or destroyed and ensuring these incidents are treated as claims and are not treated as ex gratia payments;

- Obtaining a release from the claimant in consideration of payment; and

- Accounting for all disbursements.

Furthermore, those managers with delegated authority to make payments for claims against the Crown and ex gratia payments are responsible for the following:

- Considering the legal and other merit of the claims, administrative expediency and cost-effectiveness, and reductions when the acts of omissions of any person contributed to the damage or loss incurred when deciding to make a liability payment;

- Considering whether there are any other reasonable means of compensation when deciding to make an ex gratia payment;

- Ensuring this policy is not used to fill perceived gaps or compensate for the apparent limitations in any act, order, regulation, policy, agreement or other governing instruments e.g., if a particular subject is governed by another instrument, and that instrument does not provide for such a payment, this policy cannot be used to expand that instrument and an exception to the governing instrument would need to be sought; and

- Ensuring all other possible sources of compensation be reviewed if there does not appear to be a governing instrument: e.g., statutory or regulatory schemes, other Treasury Board policies or directives, program funding, and grants or contributions.

5.2.2

Departmental managers responsible for Claims by the Crown are responsible for the following:

- Making every reasonable effort to obtain value for money when resolving a claim;

- Referring all claims involving legal proceedings to Legal Services and obtaining legal opinions when material sums are at stake or when there is a lack of evidence, conflicting evidence or uncertainty as to the applicable legal principles;

- Collecting recoveries from servants, notifying the servant of the proposed retention and of the servant’s right to make representation within 30 days and to consider the servant’s representation, if any, before making a final decision. Note that section 155 (3) of the Financial Administration Act also applies; and

- Collecting or enforcing collection of payment of the claim in compliance with the Directive on Receivables Management and the Directive on Receipt, Deposit and Recording of Money;

Furthermore, those managers with delegated authority to resolve claims are responsible for the following:

- As required, signing a release as a condition of payment being made to resolve a claim by the Crown.

5.3 Chief Security Officer

5.3.1

The Chief Security Officer is responsible for the following:

- Assisting managers with or conducting investigations based on the type of incident and the relevant dollar amount.

6. Delegations of Authority

For specific financial limitations please refer to the department’s Delegations of Authority Manual.

Aggregate amounts for claims or payments must not be split into smaller amounts, thereby avoiding controls as set out therein or in this policy.

7. Monitoring

7.1 Duty to Accommodate

This policy must be applied in conjunction with the Treasury Board Policy on the Duty to Accommodate Persons with Disabilities in the Federal Public Service.

This policy must be applied in conjunction with the Treasury Board Policy on the Duty to Accommodate Persons with Disabilities in the Federal Public Service

7.2 Monitoring and Reporting Requirements

7.2.1

The Chief Financial Officer is responsible for supporting the Deputy Minister by overseeing the implementation and monitoring of this policy in the department, bringing to the Deputy Minister’s attention any significant difficulties, gaps in performance or compliance issues and developing proposals to address them, and reporting significant performance or compliance issues to the Office of the Comptroller General.

7.2.2

Payments of out-of-court settlements of claims against the Crown, ex gratia payments, and court awards are required to be reported annually in the Public Accounts of Canada (Volume II). This ensures visibility and a measurement of accountability for losses of money entrusted to the department by Parliament and the public. There is no materiality limit and all details are reported.

8. Definitions

- A liability is the situation in which one is potentially or actually subject to some obligation.

- A tort is a wrong; generally, it is an injury other than a breach of contract for which recovery of damages is permitted by law.

- A court award is a decision or determination with respect to a claim by or against the Crown that is rendered in a court of any jurisdiction.

- An ex gratia payment is a benevolent payment in the public interest for loss or expenditure incurred for which there is no legal liability on the part of the Crown.

9. References

9.1 Relevant Acts

9.2 Treasury Board Policies, Directives and Guidelines

- Directive on Claims and Ex Gratia Payments:

- Guideline on Claims and Ex Gratia Payments:

- Contracting Policy:

- Policy on Legal Assistance and Indemnification:

- Injury-on-Duty Leave:

- Archived – Risk Managmeent Guide (Review Guide) – November 1, 1994:

- Travel Directive:

- Policy on the Duty to Accomodate Persons with Disabilities in the Federal Public Service:

9.3 Other

10. Appendix A1 – Manager’s Responsibilities Flow Chart

11. Appendix A2 –Human Resources Services Branch Responsibilities Flow Chart

12. Appendix A3 - Legal Services Responsibilities Flow Chart

13. Appendix A4 – Payment Process Flow Chart

14. Appendix B – Guidelines

Examples

- Out-of-court settlements for claims against the Crown include payments related to:

- Accidents involving Crown-owned motor vehicles;

- Compensation for expenses incurred relating to a verbal commitment to enter into a contribution agreement which was subsequently withdrawn;

- Copyright, employment-related issues, or damage to or theft of personal property.

- Ex gratia payments have been made to compensate for:

- Costs incurred by employees during periods that should have been covered by health care coverage, where coverage was not extended due to administrative error;

- Costs incurred to replace personal documentation, e.g. birth certificate, misplaced by HRSDC personnel;

- Awards for inventors and innovators based on royalties and license fees for creating commercialized technology.

- Court awards have compensated for damages, wrongful decisions, or recovery of costs.

- Claims by the Crown have included:

- Damage, loss, theft, or destruction of public property, including moveable or immovable property, which belongs to the Crown or is in the possession of the Crown; and

- Personal injury, or death as a consequence thereof, to servants of the Crown.

Examples of Exclusions

- This policy cannot be applied to the following situations:

- Claims that are covered by other authorities, governing instruments, or policies;

- Claims under Section 11 (Equal Wages) of the Canadian Human Rights Act;

- Claims for damages to public servants’ effects while on relocation or travel status;

- Claims for losses of public money; and

- Claims related to bodily injury while on duty.

Examples where ex gratia payments are not appropriate include:

- Claims for ineligible expenses related to contribution agreements;

- Claims for situations pertaining to Employment Insurance programs;

- Claims related to employee pay disputes;

- Legal assistance, i.e. expenses associated with defending an organization against a claim; and

- Claims for employee’s personal effects that have been damaged, lost, stolen, or destroyed.

15. Appendix C - Frequently Asked Questions

Q1. What is a nugatory payment?

The expression “nugatory payment” is no longer used. In the past, it was a term used to describe payments for claims that were settled out of court, for which no value or service was received by the Crown, but for which the Crown recognized a liability.

Q2. What is the difference between a payment for a claim against the Crown and an ex gratia payment?

The important distinguishing feature is the absence of a legal liability in the latter on the part of the Crown. An ex gratia payment is “accorded as a matter of grace, favour or indulgence, as distinguished from a payment that may be demanded as a matter of right [ex debito justitiae]”.

Q3. Can the loss or theft of an employee’s cash from their workstation be indemnified (i.e. restored by payment or compensated) by an ex gratia payment?

No, not only is such personal property not related to the employee’s performance of duties, but due care and diligence in the application of proper security measures to prevent theft of personal belongings brought into the workplace by the employee remains the employee’s responsibility.

Q4. How about if the loss or damage is incurred by a non-employee on government premises while providing a service to the government, such as consulting, for which he or she has a contractual obligation to HRSDC. Would an ex gratia payment be appropriate to compensate the non-employee in this case?

If the dispute is related to a contract in terms of performance, bidding, or otherwise, then the relevant contractual obligations and the Treasury Board Contracting Policy must be referred to. If investigation and assessment, including financial and legal advice as required, reveal that the Crown has no contractual or legal liabilities regarding the non-employee with respect to the incident, and all other forms of compensation have been considered and exhausted, then an ex gratia payment may be considered.

Q5. How about if those non-employees who do not have a contractual obligation to HRSDC? If their wallets or purses get stolen on our premises, are they entitled to an ex gratia payment?

Where there is no contractual obligation, and a loss or damage is incurred by a non employee on government premises for whom and with respect to an incident for which the Crown has no legal obligations, then if all of the policy requirements are satisfied, then an ex gratia payment may be considered an appropriate vehicle for compensation. It is important to note that an ex gratia payment is a not necessary payment, but made in the public interest to show good intention, and should not be considered an entitlement.

Q6. Is the Department responsible for funding judgments and settlement payments?

Historically, departments have only funded settlements out of their reference levels. Statutory payments for judgments have, for the most part, not been recovered from departmental appropriations; however, in 1999, the Secretary of the Treasury Board communicated a decision under which departments would become responsible for funding both judgments and negotiated settlements. A temporary funding framework was also introduced at this time, consisting of a departmental responsibility threshold of $1M for the funding of judgments and a provision for review after three years. Following the review, the Department would move to two steps: in the fiscal year 2002-2003, one half of judgments in excess of $1M would be funded by central resources; and, in the fifth year the Department would become fully responsible for the funding of both judgments and settlements.

16. Appendix D – Statement of Release (example)

Release

Know all persons by these present that (name and address of claimant) does hereby remise, release and forever discharge Her Majesty the Queen in right of Canada and (name of any officer or servant of the Crown involved), from all manners of action, claims or demands, of whatever kind or nature that (name of claimant) ever had, now has or can, shall or may hereafter have by reason of damage to or personal injury, or both, (here set out subject matter of the damage) as a result of or in any way arising out of (here set out incident and the date, time and place of occurrence).

It is understood and agreed that this Release shall only be effective when payment will have been made on behalf of Her Majesty to (name of claimant) of the sum of $________.

It is also understood that Her Majesty the Queen in right of Canada does not admit any liability to (name of claimant) by acceptance of this Release or by payment of the said sum of $________.

Signed, Sealed and Delivered in the Presence of